The Thrift Savings Plan (TSP), is a retirement savings plan similar to 401(k) plans offered to private sector employees. TSP benefit plan for members of the armed forces as well as retirees from the United States civil service.

Eligibility: Your eligibility for the TSP is determined by your retirement plan. If you are in one of the following groups, you are eligible to participate:

- A federal employee who is covered by the Federal Employees Retirement System (FERS).

- A federal employee who is covered by the Civil Service Retirement System (CSRS).

- A member of the uniformed services.

- A civilian in certain other categories of federal service, such as some congressional positions and some justices and judges. If you are unsure of which retirement system applies to you, you can inquire with your personnel or benefits office.

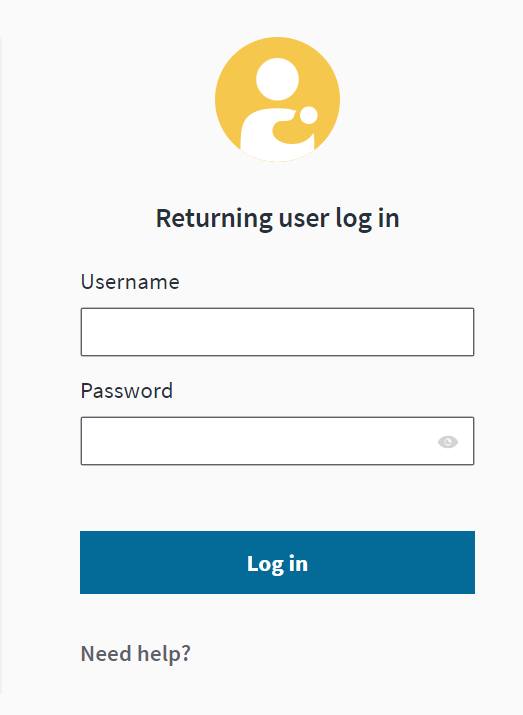

TSP.Gov Login

How do I log in to my TSP.Gov or Thrift Savings Plan account?

- You can sign in to the Thrift Savings Plan account using Username and Password.

- The first uses your direct Thrift Savings Plan account number, and the other uses your TSP User ID and password. If you forgot your TSP password, you can reset your TSP password for more visit TSP Login.

NOTE: During this TSP account set up process and in order to secure your account, you may be asked to complete TSP’s identity risk assessment or provide proof of identity through a third-party service provider. Information collected during this process is not used or stored by this vendor outside the initial account set up process.

Benefits of Your TSP.Gov Account

The Thrift Savings Plan was created to provide you with a long-term savings and investment strategy for retirement. The Thrift Savings Plan offers a number of benefits for retirement savings, including the following:

- Automatic payroll deductions.

- A diverse selection of investment options, including individual funds, and automatic payroll deductions professionally designed lifecycle funds that mix individual funds with a focus on particular target dates a mutual fund window to give you more control over your investments.

- A choice of tax treatments for your contributions traditional (pre-tax) contributions with tax-deferred investment earnings. Roth (after-tax) contributions with tax-free retirement earnings if you meet IRS requirements.

- Low administrative and investment expenses.

- Access to your money while you are employed by the federal government.

- Death benefits for your spouse in the event of your death.

- A variety of distribution options in retirement and a mutual fund window.

How the Thrift Savings Plan Works

There are multiple ways of putting resources into Thrift Savings Plan. Some examples include:

- Tax-deferred contributions into a traditional TSP means withdrawals are taxed in retirement) and after-tax investments in a Roth TSP means withdrawals are not taxed in retirement are examples of tax-deferred investments.

- Automatic payroll contributions.

- Agency matching contributions.

- The contribution limit for 2023 is $22,500, up from $20,500 in 2022, regardless of the type of TSP or contribution structure you select. In 2023, employees over the age of 50 can also make $7,500 in catch-up contributions, up from $6,500 in 202.

How to Invest in TSP.Gov

For your retirement, Thrift Savings Plan offer a variety of investment choices. From a short-term U.S. Treasury security to domestic and international stock index funds, you can select your own investment mix. Or, if you’d rather, go with one of Thrift Savings Plan Lifecycle (L) Funds, which use a professionally chosen investment mix to provide a well-balanced investment strategy based on when you’ll need money.

Thrift Savings Plan Funds Types

The Thrift Savings Plan offers a choice of six funds and a mutual fund option:

- The Government Securities Investment (G) Fund: The G Fund invests in U.S. Treasury securities with a short maturity. You have the chance to earn interest rates that are comparable to those on long-term government securities without having to worry about losing your investment.

- The Fixed-Income Index Investment (F) Fund: A separate account that tracks the Bloomberg Barclays U.S. Aggregate Bond Index holds the investments for the F Fund.

- The Common-Stock Index Investment (C) Fund: The Standard & Poor’s 500 (S&P 500) Stock Index is tracked by the C Fund, which invests in a separate account. This market index consists of 500 major to medium-sized American corporations’ stocks.

- The Small-Capitalization Stock Index Investment (S) Fund: A stock index fund that tracks the Dow Jones U.S. Completion Total Stock Market (TSM) Index is used to invest in the S Fund.

- The International-Stock Index Investment (I) Fund: The I Fund is put resources into a stock record store that tracks the MSCI EAFE (Europe, Australasia, Far East) Record.

- Specific Lifecycle (L) funds and also mutual Fund Window: Participants who may lack the time or expertise to manage their TSP retirement savings are the target audience for the L Fund.

Frequently Asked Questions

Faq

TSP New features

New tools and features are now available to you, enhancing your TSP experience even further. The ability to execute the majority of transactions quickly and securely online is one of these new features, as are multiple ways to get in touch with TSP personnel if you need assistance and flexibility in how you access My Account. The time has come, if you haven’t already, to set up your new login for the New My Account and utilise all the new TSP tools and features.

- Access account and security.

- Withdrawals and distributions.

- Loans.

- Beneficiary information.

- Efficient online transactions.

- Expanded support options.

- Investements.

How Do I Contact TSP Administrators?

Thrift Savings Plan Thriftline can be reached at 1-877-968-3778, Monday through Friday, from 7 a.m. to 9 p.m. Eastern Time. Additionally, there is a non-toll-free international phone number at 404-233-4400 and for general inquiries, you can email [email protected].

By dialing 711, individuals with hearing or speech impairments can access the 711 TTS Relay. AVA, the TSP virtual assistant, can also be used from your Thrift Savings Plan account page. Thrift Service Center, C/O Broadridge Processing, PO Box 1600, Newark, NJ 07101-1600, TSP General Mailing Address.

Supported browsers

TSP.Gov web pages are supported with one of the following browsers:

- Chrome.

- Firefox.

- Safari.

- Microsoft Edge.

For all browsers listed above, its recommend using the current version with automatic updates enabled.

Read also: Move money into the Thrift Savings Plan TSP Share price calculation TSP.Gov Form 70 Form TSP-70 General Information And Instructions Leaving the Federal Government TSP Benefits Who Return to Federal Civilian Service Returning to the Federal Government TSP.Gov New Features TSP Withdrawal Rules and Options